Article

PART 1: Canada’s Competitive Banking Sector - Foundation of the Canadian Economy

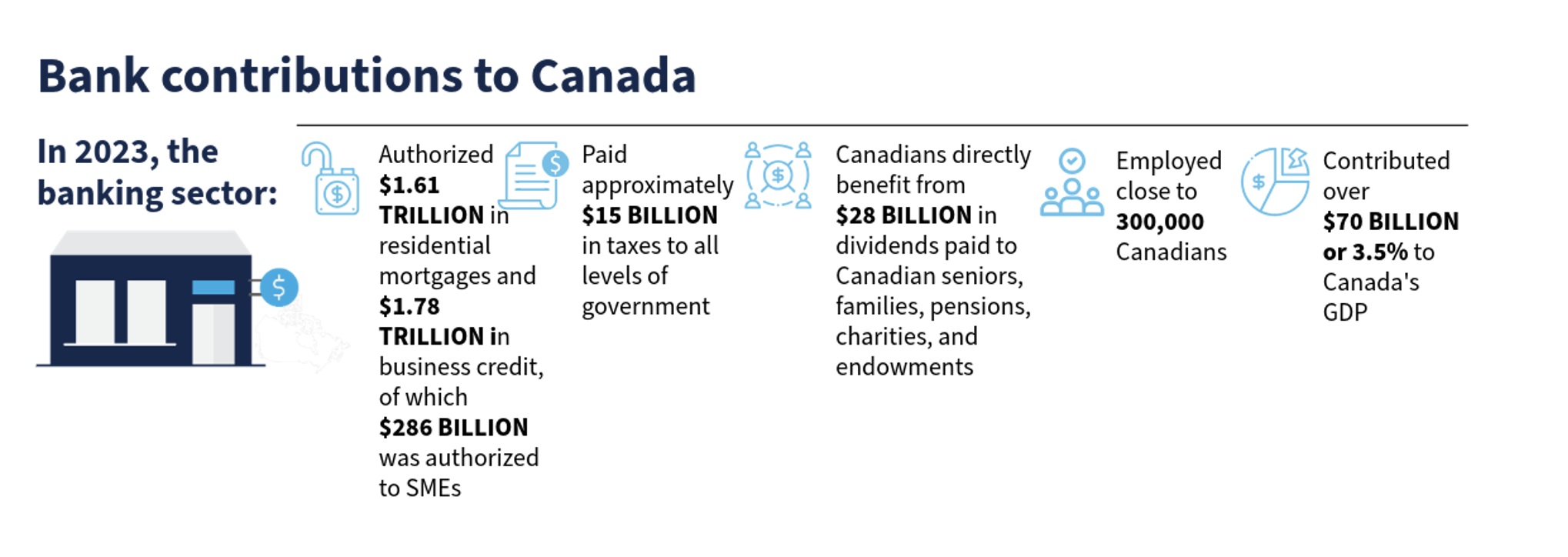

Canada’s banks have a longstanding and continuing record of supporting our country’s economy and investing in our communities.

- In 2023, banks contributed over $70 billion (or 3.5%) to Canada’s GDP

- The same year, banks paid approximately $15 billion in taxes to all levels of government and generated over $28 billion in dividend income that went to Canadian seniors, families, pensions, charities, and endowments

- The banking sector employs close to 300,000 people, a workforce represented by women (55%) and self-identified visible minorities (43%), highlighting a workforce that is inclusive, equitable, and talent-driven

- According to CBA statistics, at the end of 2023, banks in Canada have lent, in total, more than $1.61 trillion in residential mortgages and authorized nearly $1.8 trillion in business credit, of which $286 billion was authorized to support small- and medium-sized businesses (SMEs)

- Since 2010, on average, 87% of small business debt financing requests have been approved annually in Canada

The Competitive Landscape

Canada’s banks operate in an intensively competitive financial services marketplace. There are 79 banks licensed to operate in Canada, including:

- Six large banks operating coast-to-coast across all product lines

- 28 small and mid-sized domestic banks focused on specific regional markets or specific product lines, and

- 15 foreign bank subsidiaries and 29 foreign bank branches providing targeted financial products and services to Canadian families and businesses

Banks in Canada are licensed at the federal level which permits them to provide products and services across the country. This means that banks can and do compete with each other in markets across the country, and serve Canadians from coast to coast.

In addition to competing against each other, banks compete with other financial services firms in virtually every market and virtually every product and service line. This includes:

- 3 federal credit unions, which provide a full line of financial products and services to Canadians and can offer their services nationwide

- More than 400 provincial credit unions and caisses populaires, which provide intense regional competition particularly in markets such as Quebec (41% of retail, small business and commercial deposits) and British Columbia (18% of retail, small business and commercial deposits)

- government-owned deposit-taking and finance institutions that play a dominant role in certain regions (e.g. ATB in Alberta) and market segments (e.g. agriculture)

- 65 life and health insurance companies1

- More than 196 general insurance companies2

- 150 investment fund companies3

- 167 securities dealers4

- Over 200 specialized finance companies5, and

- An estimated 3,000 payment services providers offering services that hold and move money on behalf of individual and business customers6

The Impact of Digitalization

Digitalization has revolutionized and amplified competition for banking products and services. Long ago, competing in the banking market meant establishing a large network of physical branches with the personnel, systems and infrastructure to move large volumes of physical cash, coins and paper payments items across the country. Competition meant size, scale, and cost. Digitalization has changed the competitive dynamic completely:

- Digitalization allows competitors to compete nationally without branches. Mobile and on-line banking are now the overwhelming channel of choice for Canadians. Over three quarters of Canadians say their preferred way of banking is digital, either on their mobile device (30%) or their laptop computer (47%)7. Competitors only need an app and a website to reach most Canadian consumers through their channel of choice. It is estimated that there are over 4,800 fintech startups in Canada8

- Digitalization allows competitors to service customers without a large support infrastructure. Money, payments and transactions have moved overwhelming from paper to digital. In the financial system, digital transactions9 now represent 84% of total transactions. At the retail level, digital payments account for the overwhelming majority (95%) of retail spending10. Competitors only need telecommunications hardware and payment network connections to compete for the business of millions of Canadians

While digital is now the channel of choice for most Canadians, branches are still an integral part of the overall banking environment. Canadian banks have sustained their branch network to service Canadians who want or need that channel to a far greater extent than banks in other countries. Canada’s banks operate a network of over 5,600 branches across Canada, providing accessible, affordable, and competitive banking services. While down modestly (9%) from 2012 reflecting consumers’ growing use of digital channels, Canada has not seen the level of decline in branches witnessed in the UK (44%), the U.S. (16%) and Australia (39%). Branches are a core part of communities from coast to coast, and will continue to be so.

Competition Has Lowered Prices

The combination of growing competition and intensive digitalization have driven down transaction pricing for consumers and merchants:

- For bank customers, the share of bank income from retail and commercial account service charges as decreased significantly. In 2000, account service charges represented 5.0% of total income. By 2014 that had shrunk to 4.6% and by 2023 to 3.5%11

- For retailers, interchange fees paid on credit card transactions have dropped significantly. Through undertakings with the major credit card networks, average interchange fees as a percentage of transaction value decreased from 1.7% to 1.5% in 2015 and decreased further to 1.4% in 2020, saving retailers an estimated $2.5 billion12

- For investors and savers, the cost of investment products has fallen significantly. Over the past decade (2013 to 2023), management expense ratios (MERs) for mutual funds declined from 2.06% to 1.47%, and factoring in the growth of ultra-low cost exchange-traded funds (ETFs), the average MER declines even further to 1.28%13

There is an opportunity to make changes to the business and regulatory environment that will allow the banking sector to build on its strong foundation of value, innovation, and stability to serve Canadians even better and to help Canada meet its economic challenges in an increasingly complex world. The recommendations that follow build on the CBA’s Blueprint for Canadians’ Prosperity and a Thriving Economy and provide a roadmap for policy makers.

PART 2: The prescription for a stronger economy and a better regulatory system

Access to capital: enabling Canadians to start and grow businesses, creating jobs

Factoring growth into financial regulation

While the core focus of financial sector prudential regulation will always be safety and soundness, and rightly so, there is a growing recognition that prudential regulation impacts economic growth, and that impact needs to be factored into regulatory decision-making. Governments in other jurisdictions have publicly highlighted this relationship and taken steps to reflect the growth imperative in the regulatory decision-making process, and have complemented that with cost-benefit and post-implementation impact analyses to determine whether the right balance was struck. Canada needs to do the same.

Recommendation: Ensure that prudential regulation does not unduly constrict SME lending by:

- Reviewing the standardized risk weight regulators assign for small business lending to ensure that it strikes the right balance in Canada. Research from the Banque du France demonstrates that the measures employed in Europe to reduce the risk weight on SME lending had a positive effect on the level and price of credit available to small businesses.14 To facilitate small business credit formation, Canada should consider measures to reduce the level of capital that lenders need to hold to support SME lending

- Implementing cost-benefit and post-implementation impact analyses at the Department of Finance, along with its federal financial regulatory partners (OSFI, CDIC, FCAC, Bank of Canada, and FINTRAC) to determine whether regulatory measures are properly calibrated relative to their impact on economic growth. Federal financial regulatory partners should consider working with their provincial counterparts to design a consistent and coordinated approach to such analyses of financial regulation

Modernizing procurement for small businesses

The Government of Canada has done a commendable job in adapting the procurement process to the digital age through its on-line procurement portal. However, it still requires that the bidder arrange financing separately from the bidding process. Increasingly, the trend is to integrate the financing process into the contracting process to allow applicants and lenders to seamlessly incorporate the financing with the bid, and to provide the seller (in this case, the government) with the confidence that the bidder has the financial capacity to meet the terms of the contract. Examples of this structure at work can be found in dealer financing systems for auto sales and merchant financing solutions from payments processors. Integrating this model to the public procurement process would simplify and modernize the financing process for SMEs when applying for government contracts, and would expand the universe of bidders for government contracts.

Recommendation: Allow SMEs to apply for financing at the same time as they bid for government contracts by building the functionality on the federal procurement site for SME applicants to apply for financing from a list of approved lenders.

Streamlining government small business credit programs

Successive governments have sought to help small businesses by implementing programs and services to expand access to credit through lending programs, loan guarantees and other similar measures. While these programs are valuable, the challenge is that they have developed in isolation from each other and are often administered by different agencies (BDC, EDC, ISED, etc.). As a consequence, the application processes, criteria, and requirements often differ considerably. From the perspective of a lender and an applicant, this raises the cost and complexity of accessing these programs. Streamlining and, where possible, harmonizing the applicant criteria and requirements would improve take-up and lower costs.

Recommendation: Undertake an operational review of government small business lending programs with the objective of developing an integrated approach to application.

Transforming the tax system to work for Canadians

Canada’s labour productivity growth has diminished considerably, making production more expensive and Canada less competitive. This diminished growth impacts Canada’s living standards, ability to pay for government programs, and economic resiliency. Internationally, Canada ranks 18th in productivity among countries in the OECD and last among the G7.2 OECD data indicates that Canada is in the top third of member nations with respect to statutory corporate tax rates (12th highest of 37 members). More troubling, when personal taxation is factored in, Canadian investors face the third highest combined corporate and personal tax rate in the entire OECD. While we fare somewhat better when examining marginal effective corporate tax rates (24th highest among 38 member nations), the marginal rate for Canada is still well above that of leading competitors such as the U.S. and the U.K., and Canada’s average effective rate remains stubbornly among the highest in the OECD (11th). The IMF, OECD, and others have urged Canada to implement growth-oriented tax policies to reverse this trend.

At the sectoral level, governments have elected to impose specific taxes on the banking sector, limiting the amount of capital that banks can deploy to businesses for productivity enhancing measures, reducing Canadians’ ability to save and invest, increasing investment uncertainty, and reducing banks’ ability to attract necessary capital. Indeed, Australia’s Government Productivity Commission concluded that industry levies must be avoided to establish or maintain sound foundations for productivity growth.15 These taxes include:

- Recent removal of the Dividend Received Deduction, which will negatively impact middle-class Canadians who hold over 3 million retail market-linked GICs and Notes. These investments allow middle-class households, mostly approaching or in retirement, to access higher returns and manage downside risk

- The Financial Institutions Tax and the Canada Recovery Dividend, announced in the 2022 Budget, which reduced the amount of capital that can be deployed to businesses and consumers as every dollar reduction in retained earnings translates into over $7.50 of foregone new credit capacity. These taxes have also deterred foreign investment into Canadian banks. In the year before the 2022 Budget, international investors purchased $3.6 billion worth of Canadian bank equity. In the year afterwards, international investors divested $11.6 billion in Canadian bank equity

- Capital taxes imposed by six provinces4, which ultimately reduces retained earnings and penalizes banks for holding buffers to back lending. Furthermore, Québec’s Compensation Tax on Financial Institutions deters job creation and economic growth in the province

- The federal government has implemented retroactive sales taxes on payment clearing services. Retroactive taxes undermine the principles of predictability, certainty, fairness and confidence in the tax system needed by businesses to make investment decisions

Comprehensive tax reform, including removal of sector-specific taxes, is needed to improve Canada’s productivity, living standard, competitiveness, and economic growth.

Recommendation: Reorient Canada’s tax system to focus on improving Canadian productivity, job creation, new business formation and business growth by:

- Undertaking a comprehensive tax reform project of business and personal taxation anchored on the principles of tax efficiency, neutrality, certainty, and investment attraction

- Removing sector-specific taxation measures by reinstating the Dividend Received Deduction for financial institutions, phasing out the Financial Institutions Tax, and encouraging provinces to end financial institution capital taxation

- Restricting or prohibiting the use of retroactive taxation to provide certainty to businesses and investors

- Reversing the decision to increase the capital gains inclusion rate, which deters investment and makes it more difficult for growing firms to attract investors

- Publicly commit to a plan to get Canada’s statutory and effective corporate tax rate, and the combined rate faced by investors, to be among the lowest third in the OECD by 2030 and annually track progress against that objective to encourage international and domestic investment

Enabling Financial Innovation that benefits and protects Canadians

It is imperative that Canada’s financial sector regulatory landscape evolves as new players enter the market and as initiatives such as payments modernization and consumer-driven banking are rolled out. The regulatory regime needs to foster innovation and competition. It must also ensure Canadians continue to benefit from safe, secure, and reliable financial services while also having consistent protections across jurisdictions.

Canada needs a harmonized set of rules and regulations to help foster innovation and competition in financial services. This would enable market participants to more quickly and cost-effectively respond to customer demand by developing and enhancing products and services that are available nationwide.

In addition to harmonized rules among governments, we need enhanced coordination within governments. At the federal level, there are a multiplicity of initiatives ongoing including in the areas of prudential and market conduct regulation and supervision, payments, consumer-driven banking, housing, competition law, privacy law, deposit insurance, and anti-money laundering. While these initiatives tend to travel on distinct paths, they often converge around the same timelines which adds to complexity, resource burdens, and operational risk for market participants. This raises costs for businesses and consumers, slows innovation, and causes consumer confusion. We have seen governments in the U,K.16 and Australia17 attempt to address this through the establishment of a Regulatory Initiatives Grid that compiles, discloses and coordinates all the planned regulatory initiatives across a cross-section of regulators. This would allow market participants to consider and make informed decisions on the timing of regulatory initiatives. Ultimately, the Grid reduces the unnecessary administrative burden and disruption for firms, and boosts economic dynamism and resilience of the financial sector and broader economy.

Finally, Canada needs a dialogue around the role of large technology platforms that offer digital financial and related services ensuring consistent protections across the regulatory framework and empowering consumers with greater choice when accessing services digitally.

Recommendation: The federal government should ensure Canadians have the benefit of a consistent consumer protection regime from financial services providers irrespective of where they live or who they do business with by:

- Taking a leadership role in developing model financial consumer protection standards for unregulated or under-regulated financial service providers (such as e-commerce platforms and similar entities) for provincial and territorial adoption, and work with provinces and territories to adopt these standards, modelled on the consumer protection regulations to which banks must adhere

- Improving cooperation and coordination across departments and agencies at the federal level, including coordinated periodic announcements on likely forthcoming regulatory actions

- Adopting a regulatory framework that adheres to the principle of "same activity, same risk, same regulation" to ensure actors that engage in equivalent activities as banks are subject to the same rules and oversight, and encouraging provincial regulators to do likewise

Recommendation: The federal government should adopt a resilient, consumer-centric framework focussed on read-only access in the initial phase that helps Canadians realize the benefits of robust, secure and consumer-driven data exchanges while appropriately managing the risks. This can be achieved by:

- Leveraging the banking industry’s operational expertise, particularly in consumer security and data protection while fostering industry and government collaboration so each can benefit from the other’s areas of expertise

- Developing a framework where all participants are subject to reciprocal data exchanges (including financial institutions, fintechs, big tech, and other non-FIs) and subject to common rules regarding security, privacy, liability and data protection to foster consumer trust and adoption through consistent consumer protections

- Implementing measures to include options for all participants to take reasonable steps to protect consumers against security and fraud risks. These protections would also ensure that participants receiving the data are accountable for the data transfer initiated by consumers

- Leveraging existing and applicable legislative and regulatory frameworks with consistent oversight and provide all industry participants with the flexibility needed in legislation and regulation to evolve best practices while also reducing inefficiencies by avoiding prescriptive, duplicative or conflicting obligations

- Prioritizing an economically sustainable framework that includes a phased approach to implementation. With an initial focus on read only access, the approach should be informed by practical use cases and focus on protecting consumers from risks, including those from screen scraping. A measured approach to implementation will allow all stakeholders to address any unforeseen issues in the initial phase while promoting security, stability and consumer trust before the framework evolves

- Supporting a principles‑based, market‑driven approach to standards development with the designation of the Financial Data Exchange (FDX) as the technical standard in order to promote interoperability, provide participants with needed clarity to support operational readiness, and leverage FDX’s work to date as a mechanism for providing consumers with a consistent experience

Protecting Canadians from financial crime

The banking sector takes the fight against money laundering very seriously. Among the most active reporting entities under the Proceeds of Crime, Money Laundering and Terrorist Financing Act (PCMLTFA), banks devote significant resources to their anti-money laundering and anti-terrorist financing (AML/ATF) programs, internal controls, and employee training. These investments focus on continuous improvements to address the shifting landscape of compliance requirements and the evolving nature of money laundering and terrorist financing risks. They also include significant collaboration with law enforcement and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) on public private partnerships (PPPs) to help develop indicators to assist reporting entities in detecting and deterring money laundering related to certain priority predicate offences. An example of a PPP is Project Guardian, which has focused on the laundering of proceeds of crime linked to fentanyl trafficking since 2018. Overall, our members’ focus is to effectively deter, detect and report suspicious activity, mitigate money laundering and terrorist financing risks and protect the integrity of Canada’s financial system.

The CBA and our members have also actively supported much of the federal government’s recent efforts to strengthen the AML/ATF regime (the “Regime”). In particular, enhanced information sharing for AML/ATF purposes and the establishment and ongoing population of the federal beneficial ownership registry are two important developments. These new tools will help to combat money laundering and terrorist financing in Canada.

To build on these accomplishments, it is critical that the PCMLTFA and its associated regulations continue to evolve as a fit-for-purpose framework that is focused on, and keeps pace with, Regime priorities and ever-changing money laundering and terrorist financing risks. This continued evolution will help to ensure that resources are effectively allocated to higher-risk areas and enable more robust detection and deterrence of money laundering and terrorist financing.

Recommendations:

- Undertake a comprehensive review of the Regime, including the PCMLTFA and its associated regulations, to assess if it is fit-for-purpose

- Improve the Regime’s supervisory resources to ensure resources are effectively allocated to areas such as high-risk industries and activities, where AML controls and programs may be weaker

- Examine potential enhancements to the suspicious transaction reporting framework, including whether suspicious activity reporting can be tailored to the Canadian context, to help the Regime focus on money laundering and terrorist financing risks

- Increase investment in law enforcement’s investigatory and prosecutorial capacity, including establishing the Canadian Financial Crimes Agency to focus on complex financial crime and to generate statistics related to investigations, prosecutions and seized funds

- Support the implementation of private-to-private information sharing under recently finalized regulations

- Develop enhancements to the public-to-private information sharing regime with safe harbour

- Require mandatory registration of reporting entities with FINTRAC

- Establish an AML Czar to increase coordination across the AML ecosystem and focus efforts on Regime priorities

Helping Canadians by improving housing affordability

The CBA recognizes that each housing market in Canada has unique needs and challenges with respect to housing affordability. Therefore, the CBA acknowledges all levels of government for their efforts to tackle housing affordability challenges and encourage further action. We agree that responsibility for housing is shared across all levels of government and sectors. RBC Economics estimates the share of household income needed to cover home ownership costs fell nationwide to 58 per cent after reaching an all-time high of nearly 64% in Q4 2023. Nonetheless, affording a home is a challenge for average Canadians.18

As the population continues to grow across the country, we believe that an imbalance between home supply and demand will contribute to affordability challenges. The Canada Mortgage and Housing Corporation (CMHC) estimates that Canada needs to build over 3.5 million additional units above current construction trends to ensure housing affordability by 2030.19 The only sustainable option for improving affordability over the long-term is to expand the supply of housing, including rental units.

While recognizing that solutions to Canada’s housing challenges will require collaboration by a variety of stakeholders across all levels of government, the CBA has provided solutions that the federal government can take that focus largely on improving supply.

Recommendations:

- Review capital requirements and/or definitions to help lenders reduce the cost of financing the acquisition, development and construction (ADC) of purpose-built rental and multi-unit residential properties, while still maintaining appropriate risk parameters

- Reduce premiums on construction of multi-unit properties and improve mortgage funding and securitization for multi-unit properties

- Remove one of the two payment requirements to securitize such mortgages (i.e., the timely payment guarantee under the NHA MBS and CMBs), particularly for multi-unit properties

- Enhance the customer experience and reduce mortgage fraud through income verification and, specifically obtaining income data directed from the CRA with the consumers’ consent

Creating an investment climate that benefits Canadians

Canada works best when we are working together. Indeed, the Canadian economy has long benefitted from a strong, national banking system that has allowed banks to operate across the country in order to take advantage of business opportunities that allow banks to grow while mitigating risk. Other sectors of Canada’s economy do not have the same benefits due to interprovincial trade barriers.

It’s often easier for businesses to trade goods with foreign countries than across provincial borders. Statistics Canada data shows that just one-third of Canadian trade (both exports and imports) by GDP is done interprovincially, with the remainder traded to other countries (primarily the U.S. which currently receives approximately 75 percent of Canadian exports). Unsurprisingly, interprovincial trade barriers hinder the ability of Canadian businesses to grow and scale. Recent U.S. tariffs have highlighted that this simply cannot continue. We need to remove interprovincial trade barriers to enable Canada’s economy to grow, prosper and be more resilient. Canadians cannot afford to be complacent about their economic prosperity.

By removing interprovincial trade barriers, businesses and consumers can benefit through:

- Increased choices in goods and services

- Increasing the effective scale of production which improves productivity growth

- Improved security and resiliency of supply chains

- Greater affordability through competition

- A more efficient labour market

- A more resilient national economic union

These interprovincial barriers are typically non-tariff in nature and come in the form of prohibitive, technical, regulatory/administrative barriers. More specifically, prohibitive barriers arise from provincial and territorial laws that prohibit the sale of certain goods to customers in other provinces. Technical barriers stem from sector specific regulations that differ across provinces and territories. Regulatory/administrative barriers stem from provincial and territorial permits, licensing, and other paperwork requirements imposed on businesses that operate in multiple provinces/territories.20

Reducing the cost of internal trade barriers can benefit the whole economy. It is estimated interprovincial trade barriers add between 8 to 15 percent to prices of goods and services across Canada – eliminating these trade barriers would help reduce prices. Furthermore, Canada’s economy could increase between 4 and 8 percent over the long-term – a significant gain of $110 to $200 billion per year, equivalent to $2,900 and $5,100 per capita – if internal trade barriers are eliminated.21 Beyond the benefits to GDP and easing impacts on inflation, elimination of these barriers would also grow the overall tax base. Scotiabank estimates that the gains to GDP from elimination of barriers to internal trade would grow the federal (and provincial) governments’ tax base, generating tax revenue of roughly $15 billion.22

While governments have made efforts to liberalize trade in the country through initiatives such as the Agreement on Internal Trade (AIT), the Canada Free Trade Agreement (CFTA) and the New West Trade Agreement (NWTA), progress however valuable has been slow. A mutual recognition approach would be preferable due to the speed at which it could be implemented. International trade tensions have brought into sharp relief the importance of making interprovincial free trade in products and services a reality for Canadian businesses and consumers, and both the federal and provincial governments have renewed efforts to remove internal trade barriers. Interprovincial free trade would encourage innovation and foster competition, ultimately making Canada more productive and better able to compete on the world stage.

Recommendation: Make interprovincial free trade a reality by:

- Developing and publishing a series of firm targets to remove interprovincial trade barriers on a sector-by-sector basis

- Creating a joint federal-provincial task force tasked with tracking progress against those targets and publishing progress annually to provide transparency and accountability to Canadians for making interprovincial free trade a reality

- Where non-tariff barriers exist due to differences in standards, set a target date to either develop a common standard or implement a reciprocity or passporting arrangement to remove these non-tariff barriers

- Have the task force publish annually the economic value to Canada of barriers removed to date and the deadweight loss caused by remaining barriers

1CLHIA, Canadian Life and Health Insurance Facts (2024 Edition).

2Investment Funds Institute of Canada website.

3Investment Funds Institute of Canada website.

4Investment Industry Association of Canada website.

5Canadian Financing and Leasing Association website.

6Number of registrants expected with the Bank of Canada under the Retail Payments Activities Act.

7 CBA, How Canadians Bank study, January 2024.

8Tracxn (as of January 20, 2025). Fintech defined as companies offering tech-enabled financial services and IT infrastructure and software for offering and managing financial services.

9Payments Canada, Payment Methods and Trends Report 2024. Includes transactions from credit cards, debit cards, online transfers, electronic funds transfers.

10Calculated from Payments Canada, Payment Methods and Trends Report 2024. Includes debit card, credit card and prepaid card, by value.

11Calculated using OSFI data. Figure for all domestic banks. Net income includes net interest income and other income before tax.

12Calculated by CBA. Figure represents total credit card spending 2023 ($847.4 billion) multiplied by the difference in the effective interchange rate (0.3%).

13Conference Board of Canada, Funding the Future: The Economic Impact of Canada’s Investment Funds Industry, September 2024. P. 8. Blended MER including ETF calculated using market share data on p. 5.

14ACPR – Banque du France, “Lower capital requirements as a policy tool to support credit to SMEs :Evidence from a policy experiment”, Nov 14, 2019. (https://acpr.banque-france.fr/en/publications-and-statistics/publications/lower-capital-requirements-policy-tool-support-credit-smes-evidence-policy-experiment)

15OECD, Corporate income tax statutory and targeted small business rates, Combined (corporate and shareholder) statutory tax rates on dividend income, 2024 and Effective tax rates, 2023. (OECD Data Explorer)

16U.K Financial Conduct Authority, Regulatory Initiatives Grid

17Australia Government, The Treasury, Regulatory Initiatives Grid

18RBC, Focus on Canadian housing: Housing trends and affordability, December 2024

19CMHC, Canada’s Housing Supply Shortage: Restoring affordability by 2030, June 2022

20IMF Working Paper. Trade In Canada: Case for Liberalization. WP/19/158. July 2019.

21McDonald Laurier Institute. Liberalizing Internal Trade through Mutual Recognition: A Legal and Economic Analysis. September 2022.

22Scotiabank, Picking up the Twenties: Simple Proposal to Reduce Interprovincial Trade Barriers, March 2022