Canada is among the world’s most cashless societies and its people and businesses are eager adopters of digital banking and payment options. The majority of Canadians now use digital channels to conduct their banking and the fastest-growing transaction methods today are all cashless and tech-enabled.i Indeed, we have firmly entered the digital-first era.

Consumer payments in Canada have been greatly modernized over the years and important headway is also being made in the business-to-business space. Other global markets are only now beginning to enjoy the technological advances that are available in Canada, such as tap & pay, digital wallet technologies and peer-to-peer solutions, which have transformed how people buy goods and services and move money. Recent CBA polling shows that Canadians are satisfied with digital payment channels and are poised to increase their use, fuelled by an especially strong uptake by Millennials and Gen Z. Further, Canada has an impressive array of emerging companies that are active in payments technology, with Interac Corp. being a prime example of a homegrown innovation leader that has, and continues to push the boundaries of, what is possible in payments. The company was a pioneer in online peer-to-peer transactions with the introduction of e-Transfers more than 15 years ago. Today, e-Transfers now top all payment instruments in terms of growth and Canadians use it on average more than one million times a day and over 35 million times each month.ii.

While Canada is starting from a position of strength, the infrastructure that underpins our country’s payment system needs to be renewed to better reflect the new realities of our digitalized society. To that end, banks have been fully supportive of modernizing the core payments architecture and have made significant investments towards improving the security and resiliency of the country’s payments system, thereby increasing its efficiency and enhancing value to end users.iii Along this journey, banks are collaborating with partners such as Payments Canada, the Bank of Canada and other participants in the growing payments ecosystem to unlock greater potential and deliver further innovation to Canadians. This is more than just a technology upgrade; it’s a multi-phase, collaborative effort to build atop an already strong foundation.

Canada’s modernization journey

Countries around the world have been upgrading their aging legacy payments, clearing and settlement systems to enable faster payments processing, real-time settlement and data-rich transactions. Canada joined the global push in mid-2015 when Payments Canada developed a multi-year strategy for the modernization and renewal of the payment system. One of the first significant milestones occurred in 2018, when changes were made to the retail batch system to help businesses move funds faster and make time-sensitive same-day payments. Going forward, we will see further enhancements with the planned migration from the current Large Value Transfer System towards a real-time gross settlement system, the adoption of the more data rich ISO 20022 messaging standard and the release of what is known as the real-time rail (RTR), which builds on Canada’s existing real-time payments capability.

The RTR is a hallmark of the modernization program and is being designed as a platform for innovation. It will enable banks, paytechs and other non-traditional payment service providers (PSPs) to route payments over the rail and deliver unique and innovative solutions to their customers. Increasing access to the payment system, however, must be balanced with appropriate safeguards.

Retail payments oversight framework

As tested and trusted custodians of Canadians’ money and financial information, banks agree that the payments ecosystem should grow and evolve while ensuring measures are in place to protect end users, their money and data, and ensure the resiliency of the broader financial system. It is important to maintain a strong regulatory regime in Canada that can effectively manage prudential and market conduct risk as the payments sector evolves and new entrants proliferate.

Finance Canada consulted widely to identify ways to manage the known and potential risks and has proposed establishing a Retail Payments Oversight Framework. Announced in Budget 2019, the Framework is a functional and risk-based approach to regulating PSPs that will help facilitate greater participation in, and access to, Canada’s core retail payment systems.

The Framework – and its oversight by the Bank of Canada – is a vital building block in Canada’s payments systems governance, and must be enacted by the government before enabling PSPs to connect to the RTR and use the core payments infrastructure. The Framework is needed to provide an all-important baseline level of assurance to customers, payment system participants (including banks) and Payments Canada in dealing with other ecosystem participants. It will also build customers’ trust and confidence that the modernized payments system is reliable, safe and secure.

Finding balance in risk-reward

Canada, like many other advanced economies, has arrived at a critical moment where it must find ways to manage the risks of emerging financial technologies without stifling innovation. In the digital era, data security and privacy protection are paramount, and banks in Canada remain steadfast in their dedication to keeping their customers’ money and data safe. New entrants should offer similar protections proportional to the risk level of their organization. The new Framework will help achieve that once implemented.

We must all work together with the shared purpose of keeping sensitive personal and commercial information safe and secure, especially since all the players in the chain are in the business of providing trust to their customers. Without the proper protections in place, we run the risk of eroding that hard-earned trust.

Banks in Canada support competition and innovation in the payments sector and will continue to work collaboratively with Payments Canada and the Bank of Canada as they continue to deliver on the modernization program. It is an ambitious undertaking in terms of its breadth, complexity and interdependencies. Payment systems support commerce and underpin the entire Canadian economy, so a journey of this scale and complexity requires coordinating efforts across the financial industry and moving forward with appropriate care and diligence.

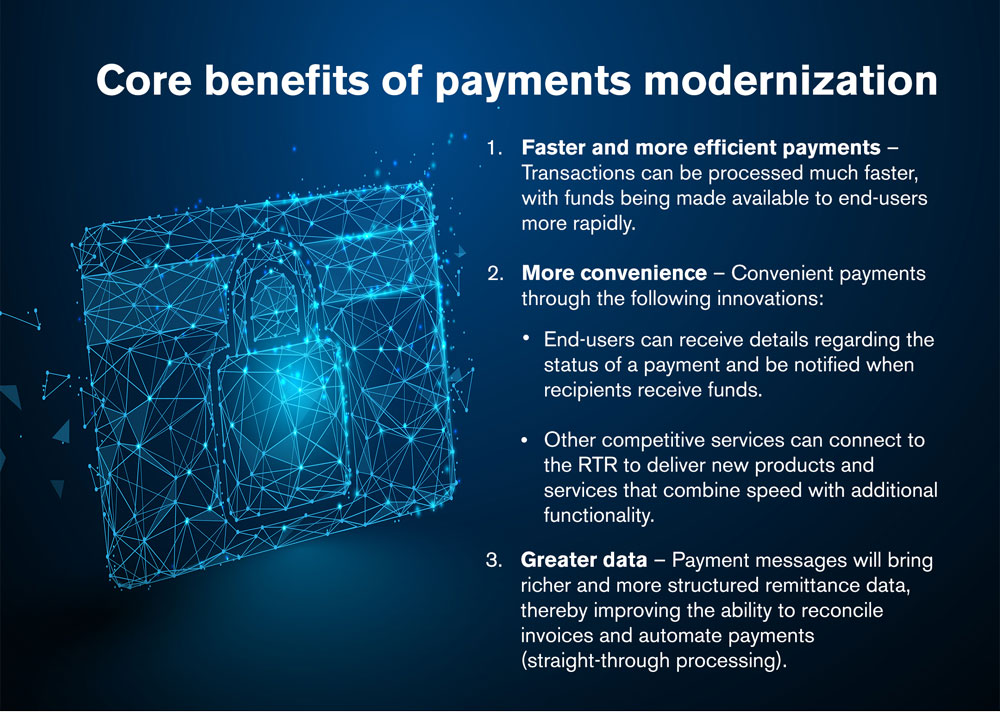

Core benefits of payments modernization

- Faster and more efficient payments – Transactions can be processed much faster, with funds being made available to end-users more rapidly.

- More convenience – Convenient payments through the following innovations:

- End-users can receive details regarding the status of a payment and be notified when recipients receive funds.

- Other competitive services can connect to the RTR to deliver new products and services that combine speed with additional functionality.

- Greater data – Payment messages will bring richer and more structured remittance data, thereby improving the ability to reconcile invoices and automate payments (straight-through processing).

i Canadian Bankers Association, How Canadians Bank, March 2019

ii Interac Corp., “Use of Interac e-Transfer service surges in 2018”, February 19, 2019.

iii In the context of payments, end-users refer to consumers, businesses (such as merchants and corporate users) as well as governments. Rapid advancements in information technology have helped spur the need to modernize Canada’s payments system.