Article

The CBA appreciates the opportunity to help shape Saskatchewan’s future by contributing to the Ministry of Finance’s preparation for the upcoming Budget. Representing more than 60 domestic and foreign banks, we advocate for public policies that support a sound and secure banking system, while fostering economic growth and prosperity for all Canadians. We are pleased to provide these recommendations on behalf of our members to the Government of Saskatchewan.

Recommendation 1: Support the federal government’s electoral commitment to conduct a comprehensive review of the corporate tax system. The review should aim to improve Canada’s productivity, job creation, and economy by:

- Ensuring the tax system is anchored on the principles of tax efficiency, neutrality, certainty, and competitiveness

- Removing the province’s Corporate Capital Tax on financial institutions to promote economic growth, and encouraging the federal government to end sector-specific tax measures by reinstating the Dividend Received Deduction for financial institutions and phasing out the Financial Institutions Tax

- Prohibiting the use of retroactive taxation to provide certainty to businesses and investors

- Publicly support lowering Canada’s statutory and effective corporate tax rates, and the combined rate for investors, to rank within the lowest third in the OECD by 2030 and annually track progress against that objective to encourage international and domestic investment

Recommendation 2: Harmonize Saskatchewan’s Financial Advisor and Financial Planner (FA/FP) title protection credentialling regime with Ontario and New Brunswick's existing frameworks. This should include recognizing the regulatory oversight of individuals registered as representatives or approved persons of the Canadian Investment Industry Regulatory Organization (CIRO) and the provincial and territorial securities commissions.

Recommendation 3: Support the creation of a national financial regulation framework for un- or under‑regulated payments service providers (such as e-commerce platforms and similar entities) rooted in the strong system that presently governs banks. We further encourage the Government of Saskatchewan to work with the federal and other provincial governments to establish a nationwide market conduct framework that provides consistent protections to all Canadians regardless of location.

Recommendation 4: Ensure the National Anti‑Fraud strategy addresses key requirements to combat financial crimes provincially and federally, including adequate resources to hold criminals accountable under the Criminal Code of Canada. Specifically, the CBA supports the following measures:

- Centralizing financial crimes reporting flows between the Canadian Anti‑Fraud Centre (CAFC) and Saskatchewan police agencies to better provide line of sight to authorities to track and mitigate these crimes

- Ensuring sufficient training, funding, and dedicated resources for law enforcement and prosecutors to respond to the rising volume and sophistication of financial crime

- Expanding public education initiatives to equip Canadians with the knowledge and tools they need to protect themselves against financial crime and scams

- Taking a multi‑sector approach to combatting scams, including coordinating with telecommunications and online platforms

- Replicating successful models such as Ontario's Serious Fraud Office in Saskatchewan to improve coordination and enforcement

Recommendation 5: Collaborate with the federal government to strengthen commitment to beneficial ownership transparency, in addition to investment in relevant authorities to support Money Laundering (ML) and Terrorist Financing (TF) investigations. In particular, we urge investments in Saskatchewan’s enforcement and prosecution capacity and harmonize its existing tools with federal measures. A harmonized approach will ensure effectiveness by avoiding legislative arbitrage and reduce compliance duplication across jurisdictions.

Recommendation 6: Provide policy and regulatory support to help provincially‑regulated credit unions that choose to transition to the federal credit union framework, increase financial transparency in the provincial credit union system, and align the provincial credit unions’ unlimited deposit guarantees to international and national best practices.

Recommendation 7: Strengthen public safety and community well‑being by:

- Implementing innovative and comprehensive solutions that address public safety challenges, while improving community vitality and economic growth

- Urgently increasing funding for community vibrancy projects, addiction recovery services, and expanded Police and Crisis Teams

- Enhancing community services for unhoused individuals, recognizing that this continues to be a significant challenge

- Launching local coalition efforts to revitalize heavily impacted cities and regions

Introduction

Beyond serving as a cornerstone of Canada’s strong and stable financial system, banks actively partner with Canadians to help them achieve their goals, whether purchasing a home, starting a business, saving for the future, or navigating periods of uncertainty.

Banks played a vital role in the Saskatchewan’s prosperity by:1

- Contributing approximately $1.4 billion (about 1.8%) of GDP to the Saskatchewan’s economy

- Paying close to $200 million in taxes to all levels of government in Saskatchewan and generating more than $29 billion in dividend income for Canadian seniors, families, pensions, charities, and endowments

- Employing close to 4,700 people in Saskatchewan in an inclusive and equitable workforce, with women representing over 60% and self-identified visible minorities comprising nearly 35%

Banks helped Saskatchewanians:

- Purchase homes, with more than $26 billion in residential mortgages outstanding2

- Start and grow businesses, with more than $20 billion in credit authorized for small and medium‑sized enterprises and authorized close to $73 billion in total business credit3

- Facilitate access to financing, approving nearly 9 in 10 small business debt financing requests annually since 20104

Banks partnered with agricultural clients, delivering tailored solutions to meet their unique needs:

- Authorized close to $20 billion across Saskatchewan and Manitoba

- Canadian banks have a long and proud history of working with farmers, from extreme weather events, animal viruses to the COVID-19 pandemic and rail strikes

An increasingly competitive and evolving financial services landscape

Saskatchewan’s financial services sector is highly competitive. Six domestic systemically important banks (DSIBs) compete with 73 domestic and foreign small- and medium‑sized banks (SMSBs) and federal credit unions that are regulated federally and able to collect deposits across Saskatchewan. This competition is further intensified by over 30 provincially regulated credit unions.5 Financial institutions recognize the vital role physical branch locations play in ensuring access to essential and specialized banking services, building relationships, and supporting local economies. Collectively, they operate over 400 branches across the province, with banks operating nearly 50 percent and credit unions the remainder.6

Competition is equally strong in the mortgage market. Nearly 30 federally regulated banks and credit unions compete with more than 40 non‑bank financial institutions (including mortgage finance companies, trust companies, and insurance companies) as well as local credit unions approved under the National Housing Act (NHA).7 Non‑NHA firms and private lenders further expand the competitor landscape.

Deposit‑taking institutions and lending entities are only a component of the financial services and products sector. Banks and other deposit‑taking institutions compete with government‑owned deposit‑taking and finance institutions, life and health insurance companies, general insurance companies, trust companies, mutual funds, securities dealers, investment advisers and specialized finance companies. Furthermore, the financial sector is evolving, as new technology and service providers enter the competitive landscape. Examples of these new entrants include large technology platforms with growing access to consumer data and fintech payment services providers, buy‑now‑pay‑later companies, digital currency exchanges, robo‑advisors. Indeed, a broader assessment identifies close to 5,100 fintechs and technological giants are offering or embedding financial services into their platforms further fragmenting the financial marketplace.8 Adoption of digital‑first banking is widespread with 84 percent of financial transactions and 95 per cent of retail spending occurring digitally.9 These new rivals leverage leveraging telecommunications network and payments systems to offer digital‑first, low cost alternatives, and many consumers come to expect seamless digital financial solutions.

In response, Canada’s major banks have invested approximately $120 billion in technology over the past decade to enhance consumer experience, reduce costs, and maintain competitiveness.10 These strategic investments have contributed to labour productivity growth in the Finance and Insurance sector of 2.4 percent annually since 2007, the second fastest rate among all Canadian industries.11 Regulators are also advancing initiatives such as consumer‑driven banking and real‑time rail payments to further encourage innovation and consumer choice.

Canadians are benefiting from the increased competition and innovation in the financial sector. Average credit card interchange fees for retailers fell from 1.7 percent in 2014 to 1.4 percent in 2020, saving merchants an estimated $2.5 billion. Small business interchange fees fell even further, reaching 0.95 percent in 2024. Investment costs have also decreased: mutual fund management expense ratios (MERs) declined to 1.47 percent in 2023 from 2.06 percent in 2013. With the emergence of ultra‑low‑cost exchange‑traded funds, the average MER declined further to 1.28 percent.12

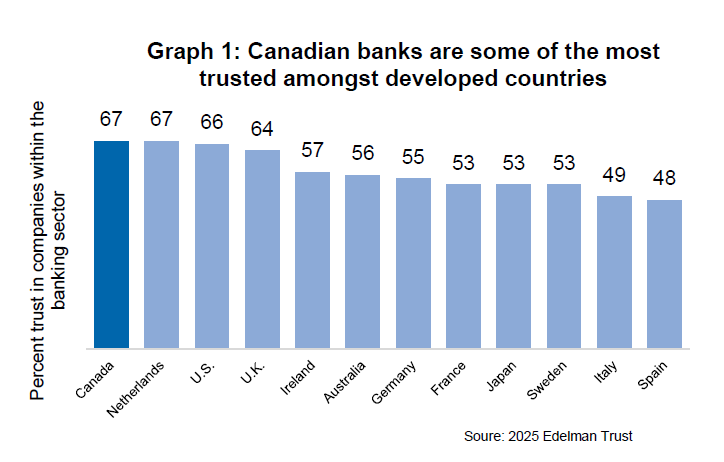

The financial sector is also influenced by regulatory initiatives that focus on consumer protection and market stability (e.g., AML, privacy rules, cybersecurity). Canadian banks have been complying with these public policy initiatives while providing competitive services and maintaining some of the highest levels of consumer trust among developed countries (Graph 1).

Recommendation 1: Reform the tax system to work for Canadians

Canadians’ standard of living, as measured by real GDP per person, was lower in 2024 than in 2014. Canada risks continued deterioration in living standards without improvement to its low labour productivity, ultimately resulting in wage stagnation, constraints to governments’ public services, increased production costs, and reduced competitiveness globally.

Canada’s productivity has declined significantly over time, falling from sixth place among Organisation for Economic Co‑operation and Development (OECD) countries in 1970 to 18th in 2022 and ranks second last among G7 countries.13 In relation to our largest trading partner, productivity in Canada is approximately 30 percent lower than in the U.S., comparable to levels seen in lower‑income states rather than in innovation leaders like California or New York.14

Furthermore, since the last comprehensive review nearly 60 years ago, Canada’s tax system has evolved without a consistent focus on foundational tax policy principles that underpin domestic and foreign investment, economic growth, and innovation. The International Monetary Fund (IMF), the OECD, and others have urged Canada to implement growth‑oriented tax policies. This is unsurprising given Canada’s loss of its business tax advantage internationally: it now ranks 12th of 27 OECD countries in median corporate tax rates, has the third highest combined corporate and personal tax rates in the OECD, and maintains a stubbornly high (11th in OECD) average effective tax rate that is well above those in U.S. and the U.K.15

Targeted taxes on the financial services sector have further undermined economic growth and productivity by limiting banks’ capital available for Canadian businesses, reducing Canadians’ ability to save and invest, and dampening foreign investment. Other countries recognize the negative effects of sector‑specific taxes with Australia’s Government Productivity Commission concluding that industry levies must be avoided to establish or maintain sound foundations for productivity growth.16

Canada’s targeted taxes include:

- Capital taxes imposed by Saskatchewan and five other provinces reduce banks’ retained earnings and penalizes prudential capital buffers

- Removal of the Dividend Received Deduction, impacting over 3 million Canadians holding market‑linked GICs and notes, often middle‑class households close to retirement who seek stable returns and downside protection

- The 2022 Financial Institutions Tax and the Canada Recovery Dividend curtailed credit capacity to businesses and consumers as every dollar reduction in retained earnings translates into over $7.50 of foregone new credit capacity. These taxes also led to a divestment of $11.6 billion in Canadian bank equity by foreign investors in 2023

- Retroactive sales taxes on payment clearing services undermine the tax system’s principles of predictability, certainty, fairness, and investor confidence

Canada’s persistent productivity challenges, combined with heightened uncertainty arising from trade and tax policies in the U.S., underscore the need for comprehensive tax reform more than ever. Strengthening Canada’s resilience to external economic shocks will require a tax system that is modern, efficient, and competitive. We were encouraged by the Prime Minister’s campaign promise, which included a commitment to review Canada’s corporate tax system, guided by the principles of fairness, transparency, simplicity, sustainability, and competitiveness and encourage provinces to support such a review.

Recommendation: Support the federal government’s electoral commitment to conduct a comprehensive review of the corporate tax system. The review should aim to improve Canada’s productivity, job creation, and economy by:

- Ensuring the tax system is anchored on the principles of tax efficiency, neutrality, certainty, and competitiveness

- Removing the province’s Corporate Capital Tax on financial institutions to promote economic growth, and encouraging the federal government to end sector-specific tax measures by reinstating the Dividend Received Deduction for financial institutions and phasing out the Financial Institutions Tax

- Prohibiting the use of retroactive taxation to provide certainty to businesses and investors

- Avoiding any increase to tax structures that deters investment in Saskatchewan, making it more difficult for firms to scale (e.g., capital gains inclusion rate)

- Publicly support lowering Canada’s statutory and effective corporate tax rates, and the combined rate for investors, to rank within the lowest third in the OECD by 2030 and annually track progress against that objective to encourage international and domestic investment

Recommendation 2: Harmonize Financial Planner and Advisor (FP/FA) credentialling to support labour mobility

Banks collectively employ tens of thousands of individuals across Canada as Financial Planners and Advisors (FPs and FAs), including a significant number in Saskatchewan. As nationwide employers, banks invest significant resources to ensure their FPs and FAs comply with the existing provincial title protection requirements. Additionally, banks are actively engaged in public consultations on these title requirements in Saskatchewan, Manitoba, New Brunswick, and Ontario.

To the greatest extent possible, and consistent with Canada’s broader goal of reducing interprovincial trade barriers, the approach to FA/FP title protection should be harmonized across provinces and territories. A harmonized framework achieves several key benefits, including:

- Preventing an "advice gap": Setting credentialling standards substantially higher than those already established in Ontario and New Brunswick may reduce the number of qualified FAs/FPs, inadvertently limiting consumer access to much needed advice on financial products

- Preventing consumer confusion: Consistent standards across Canada helps ensure that consumers can trust the qualifications of financial professionals, regardless of where they are located

- Facilitating professional mobility: A harmonized regime will allow financial professionals to move seamlessly between provinces and territories, supporting financial firms and credentialling bodies that operate nationally, while ensuring a consistent level of service for consumers across Canada

- Reducing burden: Avoiding duplicative regulation will minimize unnecessary compliance costs for market participants

Recommendation: Harmonize Saskatchewan’s Financial Advisor/Financial Planner (FA/FP) title protection credentialling regime with Ontario and New Brunswick’s existing frameworks. This should include recognizing the regulatory oversight of individuals registered as representatives or approved persons of the Canadian Investment Industry Regulatory Organization (CIRO) and the provincial and territorial securities commissions.

Recommendation 3: Make financial regulation more efficient and consistent across Canada

Canadians continue to adopt new payment methods offered by non‑traditional payment service providers (PSPs), including Big Tech. However, these PSPs are largely un- or under‑regulated. Moreover, new payment forms such as stablecoins are emerging that do not fit neatly into the current regulatory environment.

Globally, G20 member countries and the OECD have recognized the risks associated with entities that engage in bank-like activities without bank‑like regulation. Failure to address the risks associated with these entities could create stability concerns and erode trust in the financial system. Financial services and products raise public policy issues that must be addressed by governments.

As an example, while the Retail Payment Activities Act establishes a federal framework for PSPs to address certain financial and security risks, it does not impose the full range of protections for consumers that would be applied to banks and, in particular, is silent on market conduct. Given the Bank of Canada’s recent mandated oversight of nearly 3,000 PSPs, consumer usage is likely to increase and the absence of market conduct regulation is a significant gap in ensuring fair outcomes and protection for Canadians.17

Saskatchewanians should benefit from a secure, reliable, and consistent financial system regardless of the nature of the financial payments provider or geographical residence. Therefore, it is important that un- or under‑regulated players do not introduce risk into the financial system. The financial services regulatory framework, including market conduct, should adopt the principle of "same activity, same risk, same regulation" and should continue to evolve to reflect changes in technology.

Recommendation: Support the creation of a national financial regulation framework for un- or under‑regulated payments service providers (such as e-commerce platforms and similar entities) rooted in the strong system that presently governs banks. We further encourage the Government of Saskatchewan to work with the federal and other provincial governments to establish a nationwide market conduct framework that provides consistent protections to all Canadians regardless of location.

Recommendation 4: A need for a coordinated approach to combat financial crimes

Financial crimes, such as scams, identity theft, and account takeovers, continue to threaten Canadians, with some schemes being linked to organized criminal networks beyond Canada’s borders. Reported fraud incidents have doubled over the past decade and cost Canadians more than $645 million in 2024 alone. Given that financial crimes are significantly underreported, total annual losses are estimated to exceed $12 billion.18 In Saskatchewan alone, based on 1,016 reports, financial crimes resulted in reported losses over $14 million.19

In response, the CBA is collaborating with some 50 organizations across public and private sectors (government regulators, financial institutions, telecommunications companies, law enforcement, and digital platforms) in a Canadian Anti‑Scam Coalition (CASC). CASC is dedicated to protecting Canadians through coordinated education, awareness, and prevention initiatives that address scams in all their forms. And, while prevention and education are essential, effective enforcement and prosecution are equally critical to ensure criminals are held accountable under the Criminal Code of Canada, preventing further victimization.

Protecting Canadians against financial crimes requires a coordinated and proactive strategy that spans the fraud lifecycle, from prevention and detection to enforcement and prosecution. This is why we support the federal government’s Budget 2025 announcement of the government’s intention to develop a whole‑of‑government National Anti‑Fraud Strategy. This strategy will build off the work of the CASC and bring together financial institutions, technology, and telecommunication companies to develop a cross‑sectoral approach to protect Canadians from evolving and highly complex fraud schemes. An effective National Anti‑Fraud Strategy should integrate public‑private collaboration, reinforce enforcement and prosecution capacity, and empower Saskatchewanians through education.

Recommendation: Ensure the National Anti‑Fraud strategy addresses key requirements to combat financial crimes provincially and federally, including adequate resources to hold criminals accountable under the Criminal Code of Canada. Specifically, the CBA supports the following measures:

- Centralizing financial crimes reporting flows between the Canadian Anti‑Fraud Centre (CAFC) and Saskatchewan police agencies to better provide line of sight to authorities to track and mitigate these crimes

- Ensuring sufficient training, funding, and dedicated resources for law enforcement and prosecutors to respond to the rising volume and sophistication of financial crime

- Expanding public education initiatives to equip Canadians with the knowledge and tools they need to protect themselves against financial crime and scams

- Taking a multi‑sector approach to combatting scams, including coordinating with telecommunications and online platforms

- Replicating successful models such as Ontario's Serious Fraud Office in Saskatchewan to improve coordination and enforcement

Recommendation 5: Need for a harmonized anti‑money laundering and anti-terrorist financing regime

The Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) must continue to serve as the cornerstone in Canada’s fight against money laundering (ML) and terrorist financing (TF). While the CBA may support certain changes to the PCMLTFA, we caution against introducing new provincial requirements, reporting or otherwise, on federally regulated entities. Any fragmentation of the national regime could inadvertently:

- Empower bad actors by creating pockets of legislative arbitrage if federal and provincial requirements are misaligned

- Undermine the federal government’s ongoing and important national policy efforts

- Complicate coordination among expanding set of authorities as ML and TF risks evolve, and

- Potentially exacerbate concerns with high‑level, low impact reporting

Rather than adding new layers of regulations to an already comprehensive federal framework, the CBA urges the Government of Saskatchewan to support existing Anti-Money Laundering (AML)/Anti‑Terrorist Financing (ATF) tools and invest in law enforcement to strengthen the fight against ML and TF by:

- Working with the federal government to continue to expand the transparency of beneficial ownership in Canada through a one‑stop‑shop, publicly accessible beneficial ownership registry that reflects, through aligned data points, the beneficial ownership information of corporations and other entities (e.g., partnerships, trusts, and associations) from across Canada

- Investing in law enforcement to support its investigation and prosecution of ML and TF cases and enhance coordination with relevant federal authorities

Recommendation: Collaborate with the federal government to strengthen commitment to beneficial ownership transparency, in addition to investment in relevant authorities to support ML and TF investigations. In particular, we urge investments in Saskatchewan’s enforcement and prosecution capacity and harmonize its existing tools with federal measures. A harmonized approach will ensure effectiveness by avoiding legislative arbitrage and reduce compliance duplication across jurisdictions.

Recommendation 6: Ensuring credit unions’ long‑term viability

Banks and three credit unions (currently) licensed under the federal Bank Act to operate across Canada, affording them the ability to compete by scaling and making necessary investments in technology, talent, and risk management. However, most credit unions operate under provincial oversight, generally not being permitted to carry on business outside or to merge with (or purchase assets from) credit unions outside their home province.20 In Saskatchewan, 32 credit unions service more than 500,000 members, hold nearly $38 billion in assets and over $27 billion in deposits.21

While policymakers acknowledge that scale enhances resilience, builds internal capacity (technical, operational, and strategic), and improves risk management, the process for credit union mergers of amalgamations are long and cumbersome.22 Mergers involving federal and provincial credit unions require approval from the Minister of Finance, OSFI, the provincial regulator, deposit insurers, and the Competition Bureau.23 In Budget 2025, the federal government has acknowledged the need for support for federal credit unions’ growth, via amalgamation or asset acquisitions, and to make it easier for credit unions to enter the federal framework.

Most provincial legislation is silent on a credit union’s continuance under the Bank Act, an option for credit unions to operate under the national standard or amalgamate with an existing federal credit union.24 The limited number of transitions to date highlights persistent internal regulatory barriers and greater transition flexibility is needed to allow credit unions to scale and compete across provinces.

To accelerate the approval process, the province should work with its provincial credit unions to ensure their Board of Directors’ and members’ choice for the optimal business structure is supported by:

- Ensuring a smooth and efficient process for provincial credit unions to transition to the federal level as stand‑alone or amalgamated entities and ensuring requirements (including approvals) be proportionate to the transaction

- Providing guidance that facilitates credit unions’ continuance under the federal Bank Act following an amalgamation or asset transaction between federal and provincial credit unions

One of the benefits of the federal regulatory framework is transparency: federally regulated institutions must publish monthly and quarterly financial disclosures that are published on the Office of the Superintendent of Financial Institutions (OSFI) website. Most provincial credit unions currently post annual financial statements on their individual sites. More frequent, standardized disclosures through a centralized portal would strengthen transparency of the credit union system’s financial state, helping inform depositors and borrowers when making financial decisions. Such transparency will improve visibility and understanding of key risks, promote public confidence and stability in Saskatchewan’s provincial credit union system.

Lastly, to ensure Canada’s financial system continues to remain one of the safest and reputable in the world, Saskatchewan’s unlimited deposit guarantee should be re‑examined to align with national and international best practices.

Recommendation: Provide policy and regulatory support to help provincially‑regulated credit unions that choose to transition to the federal credit union framework, increase financial transparency in the provincial credit union system, and align the provincial credit unions’ unlimited deposit guarantees to international and national best practices.

Recommendation 7: Strengthening public safety and community well‑being

Saskatchewan’s provincial crime rate and severity were the highest among Canadian provinces. In 2024, the crime rate per 100,000 remained doubled the national average.25 Escalating crime and violence are affecting communities across the province, creating heightened safety concerns for employees commuting to workplaces, forcing businesses to close, reducing family‑supporting jobs, and growing pressures on mental health and social support programs.26

While individual efforts are deployed (e.g., decriminalization, police resources, safe supply, homelessness, and mental health services), a more comprehensive, cross‑jurisdictional approach is needed. Particularly, more resources are needed in mental health services, supports for individuals facing economic stressors, and permanent housing solutions. Without continued strengthening in these areas, temporary measures such as removing unhoused individuals from ATM vestibules or businesses (by security guard services or law enforcement) displaces the individuals from one location to another and is not sustainable long-term. To that end, loitering remains a high concern for banks, accounting for approximately 75% of all annual physical security incidents. Reported incidents have increased 100% for assaults in Saskatchewan between 2022 and 2023, holding steady through 2024. Year‑to‑date data for 2025 suggests another doubling of assaults at 13 branches in the province.

We want to emphasize the importance of appropriate and effective responses to incidents involving individuals experiencing mental health challenges or addiction‑related crises. Continued expansion of Police and Crisis Team (PACT) is critical. These teams, consisting of health care professionals working alongside specially trained police officers, help and de‑escalate volatile situations and connect individuals to follow‑up care and community programs.27

The CBA is active in finding solutions to these challenges across the country. For example, in Alberta, the CBA has contributed to the Edmonton Downtown Recovery Coalition (DRC), a collaboration between business and community leaders focused on revitalizing the Edmonton downtown area. The DRC’s efforts focus on three pillars: safety and security, cleanliness and infrastructure, and transformational projects. The public safety challenges in Edmonton are prevalent across all provinces, and we recommend the Government of Saskatchewan consider launching a similar coalition to energize and stimulate the local community.

Recommendation: Strengthen public safety and community well‑being by:

- Implementing innovative and comprehensive solutions that address public safety challenges, while improving community vitality and economic growth

- Urgently increasing funding for community vibrancy projects, addiction recovery services, and expanded Police and Crisis Teams

- Enhancing community services for unhoused individuals, recognizing that this continues to be a significant challenge

- Launching local coalition efforts to revitalize heavily impacted cities and regions

Conclusion

The CBA appreciates the opportunity to contribute to the province’s upcoming Budget. Our recommendations are designed to help shape Canada’s, and Saskatchewan’s, future by fostering investment and innovation, strengthening communities across the province, and enhancing the resilience of our country’s economy. We welcome the opportunity to discuss our recommendations in greater detail and to explore efforts to collaboratively deliver benefits for Saskatchewanians.

1 2024 banking contributions provided by CBA, workforce composition based on 2023 data, Statscan.

2 Lending statistics provided by CBA.

3 Lending statistics provided by CBA (data grouped for the region of Saskatchewan and Manitoba).

4 ISED, Credit Conditions Survey, 2010 to 2022.

5 Credit Union Deposit Guarantee Corporation, Saskatchewan Credit Unions, as of January 1, 2025.

6 OSFI financial data, annual financial disclosures from financial institutions, and Canadian Credit Union Association (CCUA).

7 CMHC National Housing Act Approved Lenders.

8 Tracxn, as of October 8, 2025

9 Calculated from Payments Canada, Payment Methods and Trends Report 2024. Includes debit card, credit card and prepaid card, by value.

10 Calculated by CBA.

11 CBA calculations and Bennett Jones, Economic Outlook 2025, Safeguarding a Vital Relationship and Investing in a More Productive Economy. While the Finance and Insurance produced $93 in real GDP per hour worked, banking and other depository credit intermediation produced $113.40 in real GDP per hour worked.

12 Conference Board of Canada, Funding the Future: The Economic Impact of Canada’s Investment Funds Industry, September 2024 p., Blended MER including ETF calculated using market share data on p. 5.

13 OECD, OECD Compendium of productivity indicators 2023, February 2023.

14 RBC Thought Leadership, Canada’s growth challenge: Why the economy is stuck in neutral, June 2024.

15 OECD, Corporate income tax statutory and targeted small business rates, Combined (corporate and shareholder) statutory tax rates on dividend income, 2024 and Effective tax rates, 2023. (OECD Data Explorer)

16 Australian Government Productivity Commission, Towards Levyathan? Industry levies in Australia Research paper, December 2023.

17 Bank of Canada, Laying bare the evolution of payments in Canada, May 2024

18 Competition Bureau of Canada, Fraud Prevention Month to focus on impersonation fraud, one of the fastest growing forms of fraud, February 2025

19 CAFC 2024 Annual Statistical Report

20 Q4 Torys Quarterly: The pulse on Canada’s financial services, Reducing regulatory barriers in the financial services sector, Fall 2025

21 Canadian Credit Union Association (CCUA), Third Quarter 2024 National Sector Results, Revised January 2025

22 BCFSA, Cooperative Finance at a crossroads: Strengthening system design for what’s ahead, July 2025

23 CCUA, Stronger Together, Sooner: A Roadmap for Faster and Fairer Credit Union Merger, Reviews, August 2025

24 While Saskatchewan credit union legislation provides for continuance of a credit union in other jurisdictions, it does not explicitly mention federal continuance. Currently, Alberta and New Brunswick have legislation that explicitly contemplates the amalgamation of a provincially regulated credit union with a federally regulated credit union under federal continuance.

25 Incident-based crime statistics, by detailed violations, Canada, provinces, territories, Census Metropolitan Areas and Canadian Forces Military Police, Statistics Canada, September 2025.

26 Saskatoon credit union branch to close due to 'increased threat' to safety, CTV News Saskatoon, November 2023.

27 Core Patrol, Edmonton Downtown. Similar teams deployed in Edmonton, Alberta, have put out 99 fires without needing first responders, performed 1,088 wellness checks, and reported 549 property vandalisms. Additionally, 1,831 bags of garbage were collected, and 2,342 needles were safely removed.