It’s Valentine’s Day today and many of us have secured that hard-to-get restaurant reservation, put in a flower order, or bought chocolates for our loved ones. There’s only one hitch for those still looking for love. Before swiping right on a potential dating app match tonight, be aware of the potential risks posed by these platforms. Even the savviest users can fall victim to romance scams because easy access to advancements in generative artificial intelligence (AI) now enable scammers to craft remarkably authentic conversations.

Romance scam basics

Romance scammers are masters of manipulation. They create fake online profiles with alluring photos stolen online, sometimes assume the identities of real people, and study the information people share on social media to pretend to have common interests with their targets. These scammers play the long game and typically build a trusting and personal relationship with them over several months. Often the fraudster doesn’t even live in the same city or country as their victim, and there is always a built-in excuse for why they can’t meet in person, such as being overseas for business or military service.

Once the scammer has cultivated a fake love connection, they proceed to ask the individual for money for an emergency, often by wire transfers, convince them to receive money on their behalf, or lure victims into bogus investments, especially in cryptocurrency. In almost every case, people believe they’re helping someone they care about, but it’s all built on a lie.

The use of dating apps soared during the pandemic, causing more people to become vulnerable to online scams. According to the Canadian Anti-Fraud Centre, romance scams were responsible for some of the highest fraud-related dollar losses in 2022, costing 1,056 victims more than $60 million in losses. That’s a median dollar loss of more than $56,000 per individual – and that’s only what is reported to law enforcement. In the U.S., over the past five years people have reported losing a staggering $1.3 billion to romance scams, more than any other fraud category tracked by the Federal Trade Commission (FTC).

Same old scam, innovative approach

Romance scammers are becoming more creative and technologically well-equipped, often using AI technology to run successful scams.

• Crypto con artists – Some romance scammers pretend to be employed in financial services, promising to invest their new love interest’s money in allegedly lucrative investments, including stocks and foreign-exchange trading, but also cryptocurrency investments promising outsized results. The U.S. FTC reported that nearly $140 million of the reported losses to romance scams in 2021 alone were paid in cryptocurrency.

• Bot-driven bogus accounts – Digital experts have reported that accounts on popular dating apps are increasingly being created and run by chatbots. Instead of speaking to a human, a software application is conducting the conversation using stolen personal information inputted by the fraudster. In some reported cases, a bot will engage in a short conversation and then send a link to their fake love interest asking them to check out a fun, new game they’re playing online. The link leads the victim to a website operated by the scammer that is programmed to steal their credit card details.

• AI imposters – Scammers are employing generative AI tools using Natural Language Processing technology to pass themselves off as great conversationalists. Generative AI tools can create convincing messages that are similar to how a real person might respond in conversation making it difficult to know if you’re chatting with a genuine person or a scammer using AI. This convincing persona makes it easier to build trust and then manipulate a victim into sending money or personal information.

How to uncover the latest tricks of romance scammers

Recognizing the red flags can prevent you from losing time and money. Here are some common signs to look for:

• The person asks you for money due to some unforeseen circumstance, but you have never met them in person or heard their voice. Always be skeptical of requests for money for any reason.

• The person wants to build a personal relationship too quickly, which may indicate they have ulterior motives.

• You receive a cheque or another form of payment from someone you've met online, and they ask you to cash it and send a portion of the funds back to them. You could be an accomplice to a crime without knowing it.

• The person tells you that they live in the same city, but always make an excuse for why they can’t meet you in person.

• The person’s profile indicates they have “Just Joined” a dating app. Often they will create new profiles if their previous one has been flagged.

• The person’s pictures seem to be copied from an online search.

• The conversation is a little strange. AI-generated text or chats can often contain inconsistencies, such as repeating certain phrases or providing answers that are unrelated to the conversation.

• The conversation is moving too fast. AI-generated responses may come too quickly since AI can type faster than a real person.

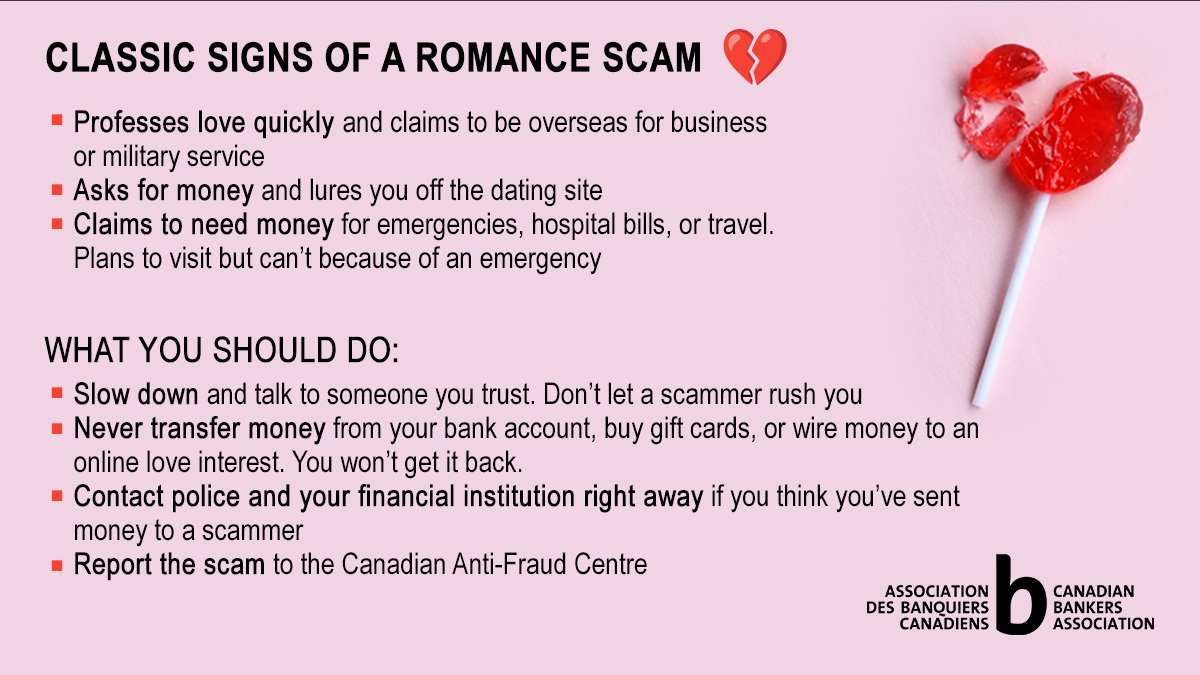

Classic Signs of a Romance Scam 💔

- Professes love quickly and claims to be overseas for business or military service

- Asks for money and lures you off the dating site

- Claims to need money for emergencies, hospital bills, or travel

- Plans to visit but can't because of an emergency

What should you do:

- Slow down and talk to someone you trust. Don’t let a scammer rush you

- Never transfer money from your bank account, buy gift cards, or wire money to an online love interest. You won’t get it back.

- Contact police and your financial institution right away if you think you’ve sent money to a scammer

- Report the scam to the Canadian Anti-Fraud Centre

Banks are committed to fraud prevention

Banks in Canada are dedicated to helping protect their customers from financial fraud. The Canadian Bankers Association (CBA) and its member banks actively share fraud prevention information throughout the year to raise awareness and provide actionable tips on how customers can detect and prevent scams, including the romance scam. The CBA also dedicates a significant portion of its financial literacy programs for older adults, Your Money Seniors, to fraud awareness and prevention.

Bank staff are aware of different fraud types and tactics and are trained to ask probing questions if a customer makes an unusual transaction. As the owners of the account, however, the customer is responsible for any funds that they withdraw from their bank account. Ultimately, banks must strike an appropriate balance between helping to prevent and detect fraud, while also protecting the rights of their customers to access their money.

This Valentine’s Day, educate yourself and your loved ones on how to prevent falling victim to the increasing threat of romance scams. If you think you may be a victim of a scam, it is important that you contact police immediately, report it to the Canadian Anti-Fraud Centre, and notify your financial institution.